So look, on self-serve, we very much believe that there are good reasons to get that business back to growth. And then balancing that, what are the key investments Vimeo needs to make in order to drive product growth?Īnjali Sud : Sure. Curious if you could talk about the range of macroeconomic scenarios you’re envisioning.

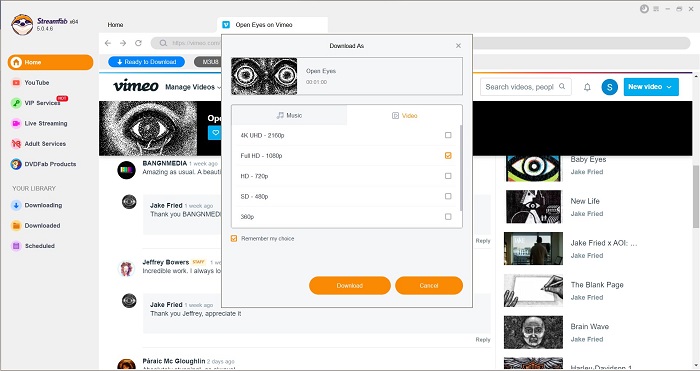

#VIMEO ON DEMAND FULL#

We like the EBITDA guide for the full year. And what does the path forward look like to get those cohorts back to stability and return the self-serve segment to revenue growth? And then, Gillian, maybe one for you. Anjali, maybe on the self-serve side, given the outsized customer growth of 2020 and ’21, help us understand the retention characteristics of these cohorts and kind of where we are through that process of anniversarying. Thomas Champion : Hopefully, you can hear me. Operator: Our first question comes from Tom Champion at Piper Sandler. We may use your email to send marketing emails about our services. This is a choice that we will keep assessing as we move through the year based on our results with the commitment to profitability in any growth scenario.

#VIMEO ON DEMAND FREE#

This is our second straight quarter of positive adjusted EBITDA and free cash flow, and we entered 2023 with the flexibility to invest in growth while continuing to improve margins. Our line of sight here is getting clearer as we get past the COVID cohorts, and we expect far more visibility over the next few quarters. Second, we believe that by simplifying our product and focusing on the fundamentals, we can get self-serve back to growth on a more normalized trajectory than the past few years. So we’ll lean into this momentum in 2023 with our investments. In under 4 years, we’ve built a business with a $65 million run rate in bookings that’s growing faster than the rest of the market.

#VIMEO ON DEMAND DRIVER#

We see Vimeo Enterprise as a big growth driver still in its early days. Net revenue retention was again above 100%, and customer usage is looking very strong. Last quarter, bookings were up 59% year-over-year. First, we have great momentum in Vimeo Enterprise. So I’d like to highlight 3 things before we take your questions. We, of course, hope that this helps to demonstrate how video can make important communications more engaging and easier to consume. We know it’s earnings season and your time is precious, so you can click and navigate through the content instead of watching it linearly or just reading the transcript.

#VIMEO ON DEMAND UPDATE#

Once again, we use Vimeo’s product to make our update fully interactive. Last night, we published an interactive shareholder video that walks through our results and outlook. With that, I’ll turn it over to our CEO, Anjali.Īnjali Sud : Hi, folks, and welcome to our fourth quarter Q&A.

Additional information regarding Vimeo’s financial performance, including reconciliations with comparable GAAP measures, can be found in our earnings release and Vimeo’s filings with the SEC as well as in supplemental information posted on the Investor Relations section of our website. These should be considered in addition to and not as a substitute for or in isolation from GAAP measures. We’ve also provided information regarding certain key metrics and our non-GAAP financial measures, including certain forward-looking measures. These forward-looking views are subject to risks and uncertainties, and our actual results could differ materially from the views expressed today. These forward-looking statements typically may be preceded by words such as we expect, we believe, we anticipate or similar such statements. Second, we will discuss Vimeo’s outlook and future performance.

First, this session will be recorded and available on the Vimeo Investor Relations site later today. We’re excited to be here with you on video. Operator: Good morning, and thank you for joining Vimeo’s fourth quarter earnings live Q&A.

0 kommentar(er)

0 kommentar(er)